Why did the Federal Reserve cut rates? Learn more here.

Read More

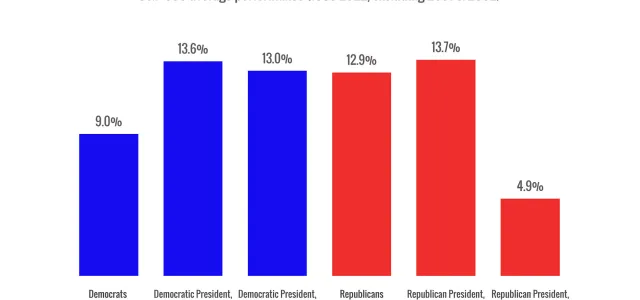

What do presidential elections mean for your portfolio?

Read More

The Dow crosses 45,000. Your brain whispers: "This has to be the top."

The market drops 15%. Your brain screams: "Get out before it gets worse!"

Different

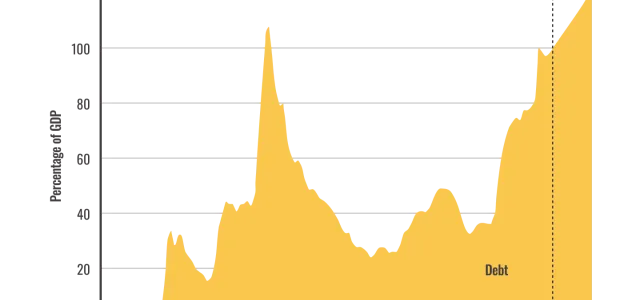

One of the world’s top credit rating agencies just made a move no one wanted to see, and the financial media took notice. As you might have guessed, that

Read More

If your portfolio is built around your goals and properly diversified, it's designed for moments like this.

Read More

It’s called the “One Big Beautiful Bill Act,” and it could represent a big overhaul to household finances.

Read More

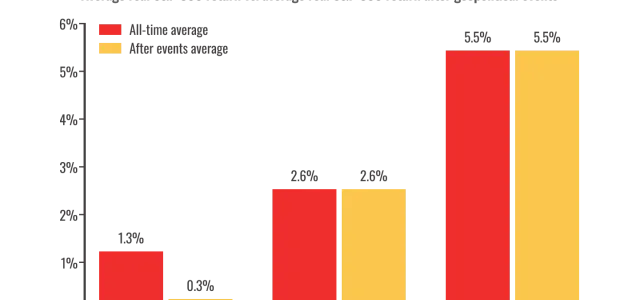

The world of finance is never static. It's an ever-changing landscape that reflects the ebb and flow of economic indicators, political events, and public

Read More

Mortgage rates have risen above 7%, leaving many buyers feeling like a reasonable mortgage is out of reach. While current rates look high compared to the ultra

Read More

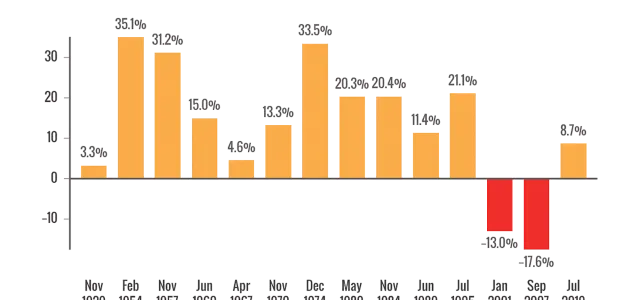

Over the course of your investing life, you’ll encounter market lows and highs. Headlines often spotlight the extremes, especially when markets reach record

If you know what mistakes tend to drain retirement savings, you can take caution, make more informed decisions, and stay on track to fund your dream retirement.

Read More

What happens when you start to feel afraid or greedy?

Do you feel like taking your time and waiting to make your next move?

Read More

What was the last money mistake you made?

If you’re like most folks, you’ve made at least one upsetting money mistake in the past year — and you’d like to do

Read More